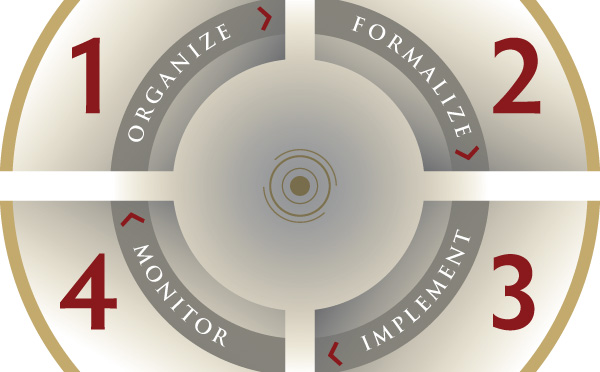

Fiduciary Quality Management Process

We firmly believe that adhering to the established process for plan management improves the participant experience. These four core practices established by The Centre for Fiduciary Excellence and are substantiated by legislation, case law or best practices.

The roles and responsibilities of all involved parties (fiduciaries and non-fiduciaries) are defined, documented, and acknowledged.

Services Include:

- Plan design review and recommendation

- Fiduciary processes evaluation

- Plan benchmarking

- Fee analysis

- Participant “retirement readiness” and education

- Vendor support and service models

- Industry/peer group benefit competitiveness

An Investment Policy Statement is created, which contains the detail to define, implement, and manage a specific investment strategy. Plan objectives and success measures are established and monitoring frequency set.

Services Include:

Services Include:

- Customized investment policy statements

- Investment selection and monitoring

- Service provider liaison

- Online “Plan Vault” to record fiduciary due diligence

The investment strategy is implemented in compliance with the required level of prudence. The investment vehicles are appropriate to the portfolio size and plan needs.

Services Include:

Services Include:

- Service provider liaison

- Enrollment meeting support

- Customized participant education campaigns

Periodic reports compare investment performance against appropriate index, peer group, and IPS objective. Plan service providers are regularly compared to alternative options to maintain cost-efficiency, service, performance and investment flexibility.

Services Include:

Services Include:

- RFP or vendor analysis guidance

- Enrollment meeting support